Zero Balance, Higher Yield: A New Model for College Affordability

November 11, 2025How Arbol Helps Financial Aid Offices Prevent Delays and Keep Students on Track

Every Financial Aid leader knows the pattern. Students fall behind on requirements. Files stay incomplete. Verification stretches longer than it should. Staff spend valuable hours chasing paperwork instead of providing the meaningful advising that supports student success.

When we look closely at why students miss requirements, one truth is clear. It is almost never a lack of effort. National research shows that over 60 percent of students find financial processes confusing, and first-generation students are far more likely to misunderstand aid requirements and deadlines (NASFAA; New America, 2022). Small misunderstandings become missed forms, incomplete verification, and deadlines that never made sense in the first place. These issues snowball into compliance risks, delayed disbursements, SAP problems, and last-minute crises that overwhelm Financial Aid teams every term.

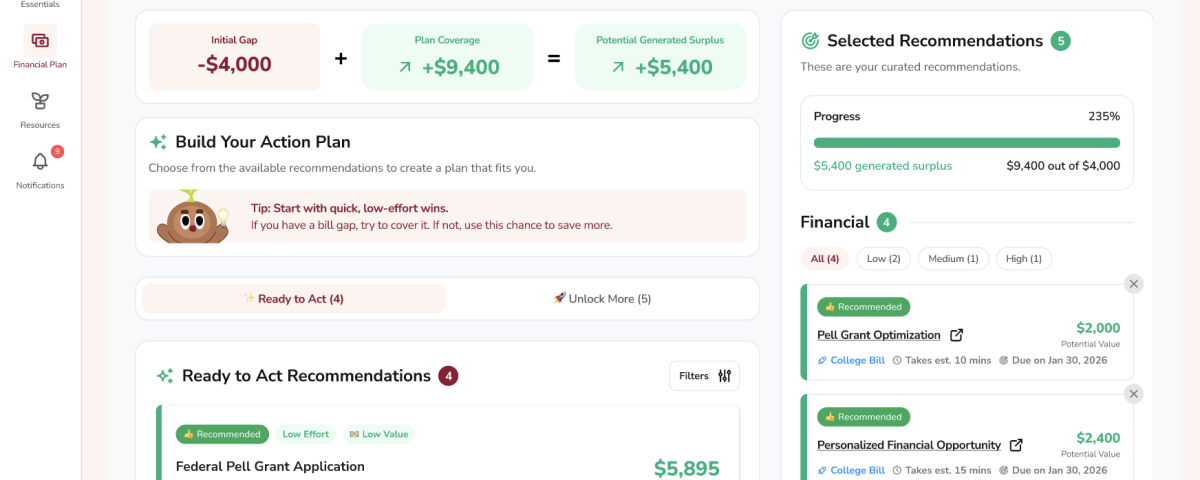

Arbol helps institutions solve this challenge by giving students a clear financial plan and giving staff early visibility into what each student needs to stay on track. The result is a smoother path from award letter to enrollment to persistence.

Students With a Financial Plan Perform Better

cross campuses, students who publish a financial plan through Arbol consistently outperform similar students who do not. These gains align with national research showing that financial clarity is linked to higher retention, earlier document completion, and improved aid eligibility (Trellis Foundation, 2023).

Arbol institutions are seeing:

• Thirty five percent lower melt rates for students who created a plan during admissions or orientation.

• Two times more likely to pay their first bill on time.

• Seven times more likely to complete all financial aid requirements before deadlines.

• Significant expansion of coaching reach without adding new staff.

These results mirror national trends. Trellis research finds that students who understand their financial responsibilities are more likely to remain eligible for aid, avoid verification issues, and persist into subsequent terms (Trellis Foundation, 2023). A financial plan provides structure, clarity, and predictability. For staff, it provides a roadmap for targeted, proactive support rather than reactive crisis management.

How Arbol Works Across the Student Journey

Arbol fits naturally into the workflows institutions already manage, enhancing the touchpoints where financial guidance matters most.

Convert Award Letters Into Actionable Plans

Students often misunderstand award letters. A national study found that nearly 40 percent of students misinterpret the difference between grants and loans in their initial financial aid offer (New America, 2022). That confusion is even higher among first-generation and low-income students.

Arbol transforms the award letter into a personalized financial plan that outlines the student’s aid package, estimated costs, remaining balance, and all required next steps. This is one of the most powerful levers for reducing summer melt. Clear, actionable information at the start of the process improves decision confidence and enrollment commitment.

Build Plans During Orientation, First Year Experience Courses, and EOP or HEOP Summer Programs

Orientation and early onboarding are ideal moments for financial planning because students are motivated and present. National student success work shows that early momentum, proactive advising, and structured onboarding are strongly associated with improved first-year retention (Tyton Partners, 2023).

Arbol integrates seamlessly into:

• Orientation checklists

• First Year Experience or college success courses

• EOP and HEOP summer bridge programming

• First semester advising sessions

By the time classes begin, students have a clear financial roadmap for the year that is tied to their real numbers, requirements, and deadlines.

Use Alerts and Reminders to Support Upperclassmen

Returning students face many of the same challenges as incoming students, but with additional responsibilities such as work, caregiving, or changing financial circumstances. National data shows that a large share of SAP failures, late verifications, and unpaid balances occur among continuing students, not just first-years (NCES, 2023).

Arbol flags missing documents, eligibility risks, and billing issues before they become enrollment barriers. Students receive simple, timely next steps. Staff gain early visibility. Institutions avoid emergency escalations and last-minute crises that often come too late to resolve without disruption.

How Arbol Helps Financial Aid Teams Get Ahead

Arbol is designed to eliminate preventable issues before they become problems.

Instead of reacting after students fall behind, Arbol shows exactly what is missing, why it matters, when it is due, and how the student can resolve it. This reduces exposure around verification timelines, SAP monitoring, R2T4 calculations, and audit findings that stem from avoidable delays.

Unified View of Every Student’s Financial Standing

Arbol consolidates data across financial aid, billing, scholarships, and personal finances in one place. Staff can instantly see what is missing, what is urgent, and where each student stands without juggling multiple systems and spreadsheets. NASFAA and Trellis have both noted that fragmented systems are a major driver of file delays and incomplete aid (NASFAA, 2023; Trellis Foundation, 2023). Arbol directly addresses that fragmentation.

Intelligent Alerts That Flag Issues Before They Escalate

Arbol automatically identifies students at risk of losing aid due to incomplete documents, unsubmitted forms, verification requirements, or changes that affect eligibility. It provides early warning without heavy manual lift. This has been especially important in recent FAFSA cycles with delays and shifting federal guidance, where small breakdowns can ripple across an entire aid year.

Personalized Checklists That Work Hand in Hand With the Plan

Research shows that students are more likely to complete tasks when instructions are personalized, centralized, and clearly prioritized (Tyton Partners, 2023). Arbol pairs every student’s financial plan with a personalized checklist that shows all tasks, deadlines, and statuses in one place.

Students do not have to hunt across portals or decipher generic to-do lists. Their checklist is tied directly to their plan and their actual financial details. When a task is completed, the plan updates. When new requirements emerge, they appear on the same checklist with simple instructions.

Step-by-Step Guidance for Students

Alongside the checklist, students receive plain-language explanations of what needs to be done, why it matters, and how to complete it. There is no jargon, no portal-hopping, and far less confusion. This clarity significantly increases the percentage of students who complete financial aid and billing requirements early and on their own.

Staff Time Redirected Toward Real Advising

Arbol frees Financial Aid teams to focus on high-value work. Instead of pulling reports from multiple systems, updating spreadsheets, and emailing students one by one, staff see a prioritized list of students who need support and can trigger guided outreach in a few clicks.

More staff time goes to complex cases, personalized counseling, and proactive advising. This shift aligns with national conversations about the need to move from reactive “transactional” aid to proactive, student-centered financial wellness (NASFAA, 2023).

Why This Helps Institutions Reach Their Goals

Improve Yield

Financial confusion is one of the top drivers of summer melt, especially among Pell-eligible and first-generation students (NCES, 2022). By giving students clarity early in the process, Arbol helps institutions reduce melt by thirty five percent and strengthen enrollment stability and forecasting.

Improve First Bill Payment and Reduce Holds

Students with clear financial plans are more likely to pay their first bill on time, which reduces collections work, lowers the number of registration holds, and helps maintain academic continuity. This supports both student success and institutional cash flow.

Improve Retention and Persistence

Financial strain is cited by over 40 percent of students who stop out as a primary reason they left college (National Student Clearinghouse Research Center, 2023). A financial plan helps students stay eligible for aid, avoid verification and billing delays, and remain academically engaged. That directly supports institutional retention and completion goals.

Scale Operations Without Adding Staff

Most Financial Aid offices report being understaffed while also facing rising complexity in federal, state, and institutional aid (NASFAA Staffing and Operations Survey, 2023). Arbol helps small teams support more students with greater precision by removing preventable issues and automating early detection. Staff shift from crisis management to proactive advising.

The Bottom Line

Students do not fall behind because they do not care. They fall behind because the financial process is confusing, fragmented, and difficult to navigate.

A financial plan changes that. It gives students clarity. It gives Financial Aid teams visibility and early warning. And it gives institutions the operational stability they need to support students at scale.

Colleges using Arbol are improving yield, reducing melt, increasing on-time bill payment, strengthening retention, and expanding advising reach without increasing staff.

This is the first entry in the “Why Every Student Needs a Financial Plan” series. Next, we will examine how Arbol supports the Bursar’s Office and helps students move through the billing cycle with confidence and predictability.

References

- NASFAA, Annual Student Experience and Policy Reports, 2022–2023.

- New America, “Decoding the Cost of College” and “Financial Aid Offers: Still Confusing, Still Misleading,” 2022.

- Trellis Foundation, “Student Financial Wellness Survey,” 2023.

NCES, Undergraduate Student Data Reports, 2022–2023. - Tyton Partners, “Driving Toward a Degree,” 2023.

- National Student Clearinghouse Research Center, “Some College, No Degree” and related stop-out research, 2023.

- NASFAA, Staffing and Operations Benchmarking Survey, 2023.

Talk With Our Team of Experts

If you see these challenges in your own funnel, our team can help you move from ideas to an actionable zero balance plan. We work with institutions that serve high numbers of Pell eligible and first generation students, and we know how to plug financial leaks without overloading staff.

We can help you:

-

Pinpoint where affordability issues are causing melt and stop outs

-

Design a simple zero balance workflow that fits your staffing and systems

-

Use Arbol Clarity to give families a clear path to a net balance of zero

If you want to explore what this could look like on your campus, reach out to our team for a brief consultation and a walkthrough of Arbol Clarity in action.